Credit cards can be a valuable tool to monitor purchases and manage the timing of payments. Difficulties can arise, however, when one is unable to pay the balance in full at the end of each month, thus incurring costly interest charges. This is especially true for students with poor credit ratings whose credit card interest rates are relatively high. These students may get trapped into a debt cycle with credit cards or even riskier products like payday and auto title loans that drain monthly income by servicing the debt.

- Students are frequently borrowing on credit cards. (Q59-61)

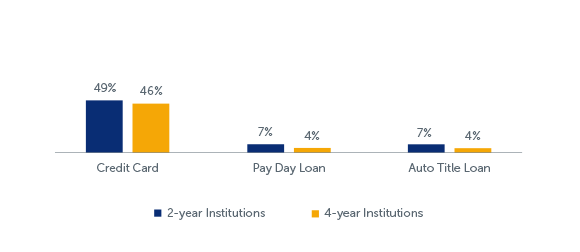

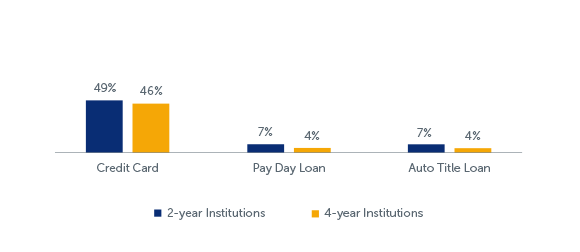

- Nearly half of respondents at 2-year (49 percent) and 4-year institutions (46 percent) reported borrowing on a credit card (for any reason, not just to pay for college) in the past 12 months.

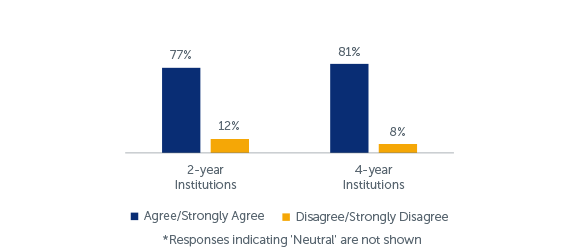

- Most respondents who borrowed on a credit card in the past year reported paying their bill on time. (Q64)

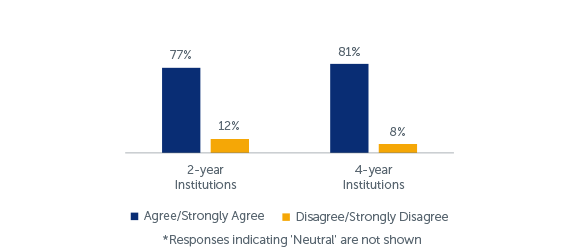

- More than three-quarters of credit card users at 2-year institutions (77 percent) – and 81 percent of 4-year credit card users – agreed or strongly agreed that they always pay their bill on time.

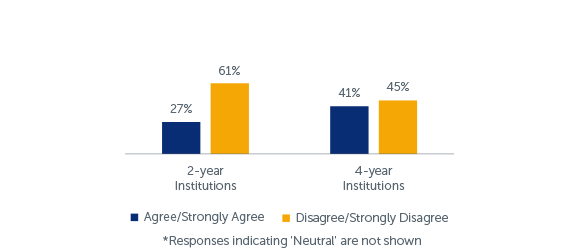

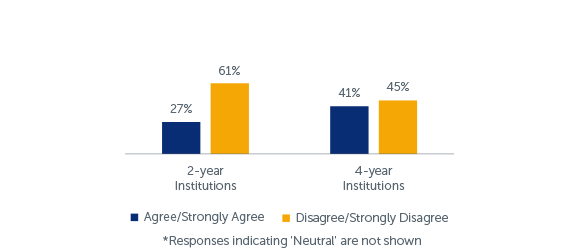

- Although many credit card users pay their bill on time, many are not paying off their full balance and are accruing interest at a high rate. (Q65)

- More than three in five credit card users at 2-year institutions (61 percent) – and 45 percent of 4-year credit card users – disagreed or strongly disagreed that they fully pay off their balance each month.

Q59-61: In the past 12 months, have you used the following borrowing sources? Respondents who answered ‘Yes’

Students are borrowing on credit cards with some frequency. (Q59-61)

- Nearly half of respondents at 2-year institutions – and 46 percent at 4-year institutions – reported borrowing on a credit card (for any reason, not just to pay for college) in the past 12 months.

Although less prevalent than credit card borrowing, payday and auto title loans tend to carry high interest rates and often use predatory marketing to target vulnerable populations.13 (Q59-61)

- Seven percent of 2-year respondents and four percent of 4-year respondents reported taking out a payday loan in the prior 12 months. Seven percent of 2-year respondents and four percent of 4-year respondents also borrowed an auto title loan during that time period.

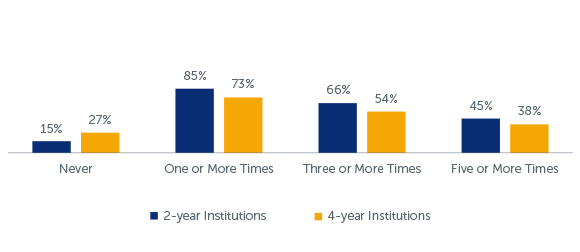

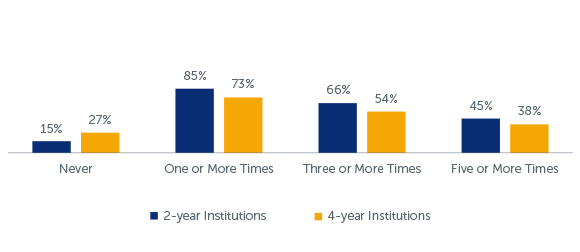

Q63: In the past 12 months, how many times did you use a credit card for something you didn’t have money for? (of those who borrowed on a credit card)

When using a credit card, students often make purchases for which they do not have money. (Q63)

- Of those respondents who borrowed on a credit card in the prior year, 85 percent at 2-year and 73 percent at 4-year institutions reported using their credit card one or more times in the prior year for something they did not have money for.

- Forty-five percent of 2-year respondents – and 38 percent of 4-year respondents – reported using their credit card five or more times in the prior year for something they did not have money for.

Q64: I always pay my credit card bill on time. (of those who borrowed on a credit card)

Most respondents who borrowed on a credit card in the past year reported paying their bill on time. (Q64)

- More than three-quarters of credit card users at 2-year institutions – and 81 percent of 4-year credit card users – agreed or strongly agreed that they always pay their bill on time.

Q65: I fully pay off my credit card balance each month. (of those who borrowed on a credit card)

Although most credit card users pay their bill on time, many fail to pay their full balance and accrue interest at a high rate. (Q65)

- More than three in five credit card users at 2-year institutions – and 45 percent of 4-year credit card users – disagreed or strongly disagreed that they fully pay off their balance each month.

Campuses can take a look at the environmental factors that support healthy financial decision making. These include campus policies and procedures related to student payments, collections, and debt products on or near campus.

Campuses can take a look at the environmental factors that support healthy financial decision making. These include campus policies and procedures related to student payments, collections, and debt products on or near campus.

Campuses can also explore additional ways to get students enrolled in safe financial services products (such as bank accounts).

Furthermore, schools can explore additional opportunities to provide financial education and loan counseling to their students.

Campuses can take a look at the environmental factors that support healthy financial decision making. These include campus policies and procedures related to student payments, collections, and debt products on or near campus.

Campuses can take a look at the environmental factors that support healthy financial decision making. These include campus policies and procedures related to student payments, collections, and debt products on or near campus.