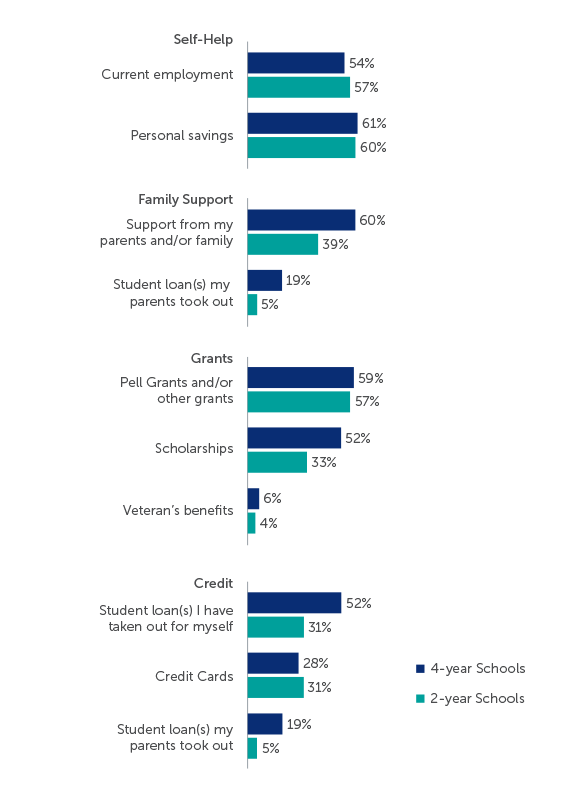

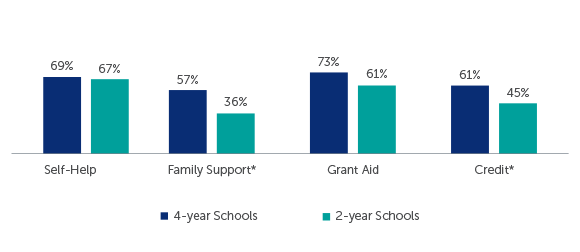

While self-help is the most common source of funding to pay for college, it rarely is enough; few students today can “pay their way through college, despite the exhortations of some.” (Q37-45)

- Over two-thirds of students use their personal savings or current employment to pay for college, typically in combination with other sources of funding.

- Over 60 percent of students at both two-year and four-year institutions use personal savings to pay for college.

- Most students depend on current employment to meet college expenses—54 percent of four-year institutions and 57 percent at two-year institutions. However, not all students view their work as paying for educational expenses. In a separate question (Q36), students were asked if they worked for pay while enrolled in college. Students at two-year institutions reported working while enrolled more often than students at four-year institutions—72 percent and 67 percent, respectively.

- As prevalent as self-help is, only two percent of students at four-year institutions and six percent at two-year institutions relied solely on personal savings and current employment to pay for college. Paying one’s way through college without help from family, grant programs, or credit is extremely rare.

Student success can bring family success. Many families pin their hopes on their children going to college. In addition to valuable emotional support, families financially support students and/or borrow on their behalf. (Q37-45)

- Students attending four-year institutions, where dependent students are more concentrated, are far more likely to receive family support to pay for college—60 percent of students at four-year institutions versus 39 percent of students at two-year institutions.

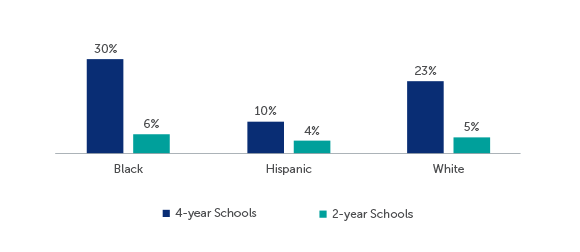

- Parents sometimes incur educational debt to financially support their children in college. This occurs more frequently among families with four-year college students (19 percent) than two-year college students (5 percent).

- Not all parents are equally able2 or willing to incur educational debt. For students attending four-year institutions, parent borrowing is more common for White students (57 percent) than it is for either Hispanic (50 percent) or Black (47 percent) students. For students at two-year institutions, parent borrowing was most frequent among families with Hispanic students (37 percent) and somewhat less prevalent for White students (33 percent) and Black students (28 percent).

Need-based grants, scholarships, and service-based benefits supplement self-help and family support to make college more affordable. (Q37-45)

- A higher percentage of students at four-year institutions (73 percent) receive aid that directly reduces out-of-pocket expenses through grants, scholarships, or Veterans benefits than students at two-year institutions (61 percent).

- For both four-year and two-year college students, access to these programs increased after the students’ first year in college, perhaps reflecting greater awareness of these programs, changes in institutional aid packaging policies, or depletion of self-help or family support. Among students at four-year institutions, 67 percent of first-year students received programmatic aid, compared to 76 percent of students who were further along in their academic progress.

- Comparable percentages of students from four-year institutions (59 percent) and two-year institutions (57 percent) reported receiving Pell Grants or other grants.

- Scholarships were far more common for students attending four-year institutions (52 percent) than those at two-year institutions (33 percent).

- While Veterans benefits can provide significant financial help for students who either served in the military or who had parents who served, only six percent of students at four-year institutions and four percent of students at two-year institutions reported receiving this form of educational assistance.

When self-help, family support, and grant assistance prove insufficient, students turn to various forms of credit. (Q37-45)

- Educational loans help support over half of the students attending four-year institutions and nearly a third of students at two-year institutions. These loans typically come with government consumer protections not found with credit cards.

- Credit cards help about 30 percent of students attending either a four-year or two-year institution to meet their educational expenses, but they can expose students to additional costs through high interest rates if only partial monthly payments are made.

While credit can be a valuable financial tool to spread out payments on a long-term investment in one’s economic productivity, borrowing also entails financial risk, with penalties for non-payment, accrued interest expenses, and threats to one’s credit history. Students face debt with different levels of preparedness. The next section examines the use of credit among college students, exploring how different demographic groups experience credit in its many forms.