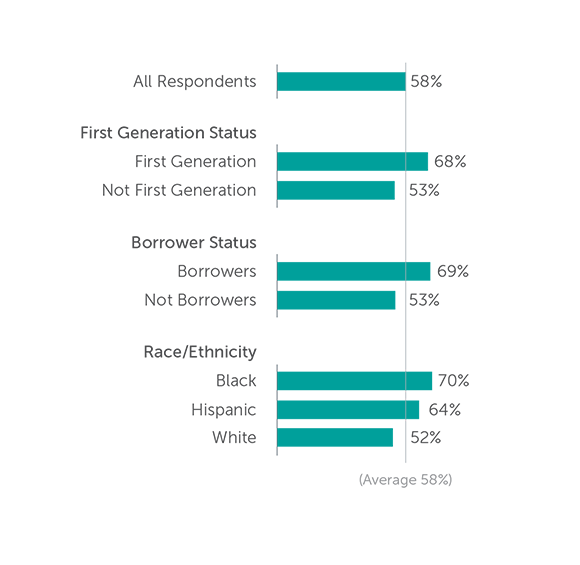

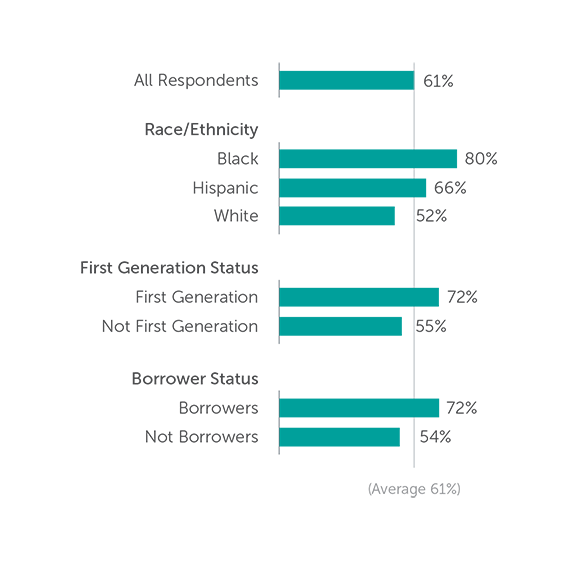

While most students said that they would have trouble getting $500 in case of an emergency, first-generation students, students who borrowed to pay for college, and students who were either Black or Hispanic were far more likely to have trouble accessing $500. (Q51)

- First-generation students are far more likely to have trouble getting $500 in an emergency (68 percent) than their classmates (53 percent).

- Similarly, students who borrow to pay for college are more likely to have trouble getting $500 in an emergency (69 percent) than students who did not borrow (53 percent).

- The ability to get $500 in cash or credit to meet an unexpected need varies widely by the racial or ethnic identity of the student. Black students were the most likely to have trouble getting $500 (70 percent). Hispanic students were a little less likely than Black students to have trouble getting $500 (64 percent). White students had the least trouble getting $500 in an emergency (52 percent).

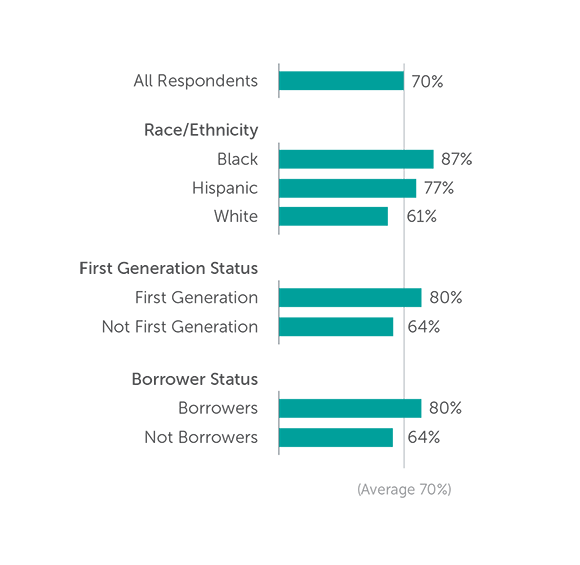

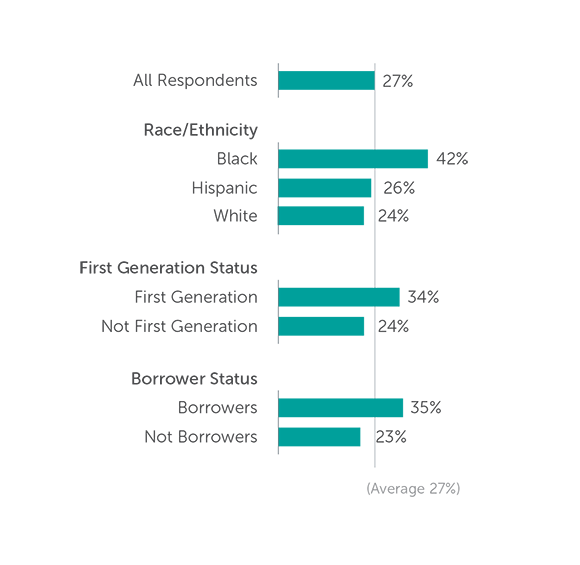

While over two-thirds of students ran out of money at least once during the past 12 months, running out of money multiple times was far more common for Black and Hispanic students, those who borrowed to pay for college, and first-generation students. (Q52)

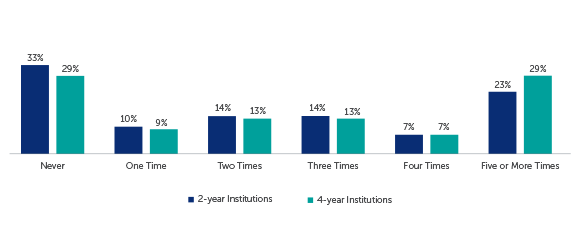

- Over half of students ran out of money multiple times (58 percent of students at four-year institutions and 62 percent at two-year institutions).

- White students were the least likely racial/ethnic group to have run out of money at least once in the past 12 months (50 percent at four-year institutions and 64 percent at two-year institutions), to have run out of money multiple times (41 percent at four-year institutions and 55 percent at two-year institutions), and to have run out of money five or more times (15 percent at four-year institutions and 26 percent at two-year institutions).

- Black and Hispanic students were much more likely to have run out of money at least once (over 85 percent for Black students and over 75 percent for Hispanic students), to have run out of money multiple times (about 80 percent for Black students and over 65 percent for Hispanic students), and to have run out of money five or more times (over 40 percent for Black students and about a quarter of Hispanic students).

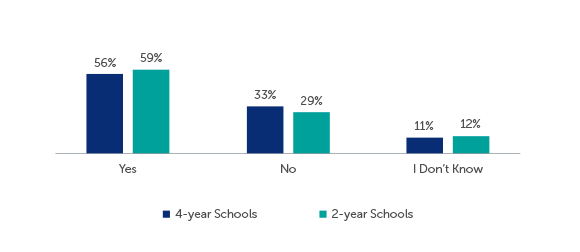

Q51: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month?

Q51: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month? Those who responded with ‘Yes’.

Q52: In the past 12 months, how many times did you run out of money?

Q52: In the past 12 months, how many times did you run out of money? Those who ran out at least once.

Q52: In the past 12 months, how many times did you run out of money? Those who ran out more than once.

Q52: In the past 12 months, how many times did you run out of money? Those who ran out five or more times.

Students living on the edge financially need timely help in emergencies.

Problem:

Inadequate financial security can threaten continuous enrollment as students stop out to address financial crises.

Solution:

Implement emergency aid programs that help students overcome temporary financial obstacles (e.g., car repairs, gaps in daycare coverage, rent assistance when roommates leave, and utility bill spikes).31 To better support institutions that may be developing emergency aid programs, Trellis has developed a useful, step-by-step guide for delivering emergency aid programs:

- Delivering Emergency Aid Services During COVID-19:

https://www.trelliscompany.org/portfolio-items/delivering-emergency-aid-services-during-covid-19/ - Trellis Company Emergency Aid Toolkit:

https://www.trelliscompany.org/wp-content/uploads/2020/04/70837_Emergency-Aid-Toolkit.pdf