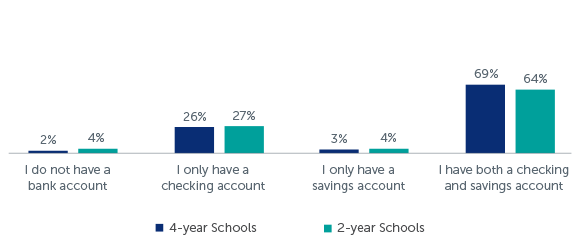

Almost all students had bank accounts, and most had both a checking and a savings account. (Q70)

- Nearly all surveyed students had bank accounts—98 percent of students attending four-year institutions and 96 percent of students at two-year institutions.

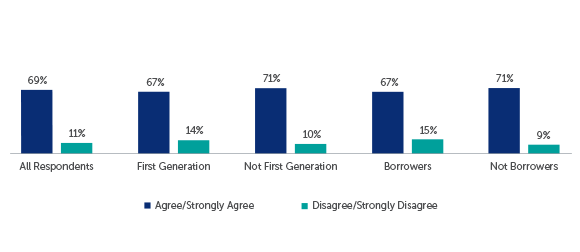

A large majority of students say that they always pay their bills on time. First-generation students and those with educational loans were less likely to always pay their bills on time. (Q54)

- First-generation students are more likely to say they do not pay their bills on time (14 percent) than their classmates (10 percent). Students who borrowed to pay for college were more likely to report not paying their bills on time (15 percent) than their classmates who didn’t borrow (nine percent).

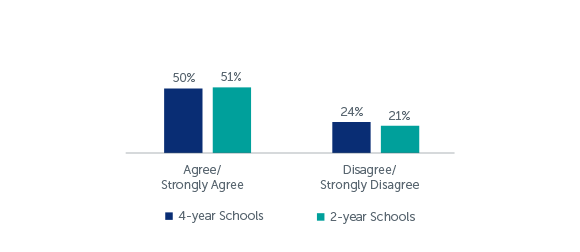

While about a half of students reported following a regular budget, nearly a quarter do not. (Q55)

- Nearly a quarter of four-year students (24 percent) disagreed or strongly disagreed that they follow a budget. Students at two-year institutions were marginally less likely to report not following a budget (21 percent).

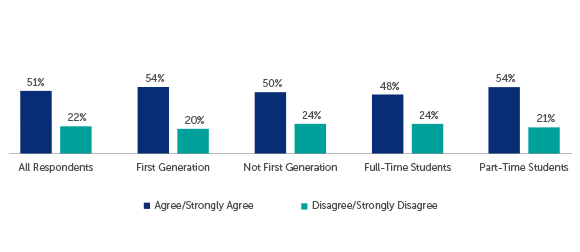

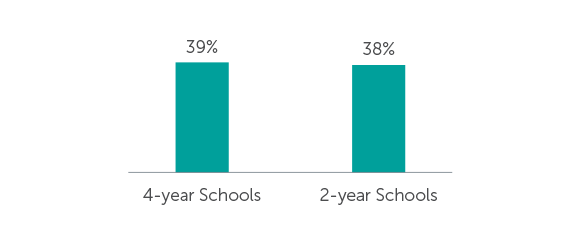

Nearly 40 percent of students have a bank account, always paid their bills on time, and followed a regular budget. (Q70, Q54-55)

- There was very little difference between students at four-year institutions (39 percent) and those at two-year institutions (38 percent) regarding the prevalence of having positive financial behaviors for all three questions—having a bank account, always paying their bills on time, and following a budget.

Q70: Do you have a bank account, and if so, which of the following applies to you?

Q54: I always pay my bills on time.*

*Responses indicating ‘Neutral’ are not shown

Q55: I follow a weekly or monthly budget.*

*Responses indicating ‘Neutral’ are not shown

Q55: I follow a weekly or monthly budget.*

*Responses indicating ‘Neutral’ are not shown

Q54-55, Q70: Displayed All Three Positive Financial Behaviors

Students lacking financial security need help building savings that allow them to weather financial crises.

Problem:

Without adequate financial reserves, students may struggle to stay in school when confronted with even moderate financial difficulties.

Solution:

Support and incentivize students to become enrolled in safe financial services (such as bank accounts). Access to a checking and savings account may reduce the chance that students will use risky financial services (such as check cashing services, pay day lending, etc.).21 An example of incentivized saving, Austin Community College’s Rainy Day Saving Program encourages students to save $500 and partners with a local credit union to match students’ savings up to $100.22

Students need help building their financial decision-making competencies.

Problem:

Higher education financing presents unique challenges to financial decision-making that are especially difficult for students who are either entering college for the first time or who are the first in their family to attend college. Students are often surprised by unexpected educational expenses like the cost of college textbooks, the price to park on campus, student fees, etc. These irregular expenses are hard to budget for without expert guidance from campus officials.

Solution:

Support students with managing their cash flow challenges (particularly with financial aid recipients) and provide financial education to encourage budgeting and successful financial behaviors.23,24