State of Student Aid in Texas – 2018

Section 6: Loans

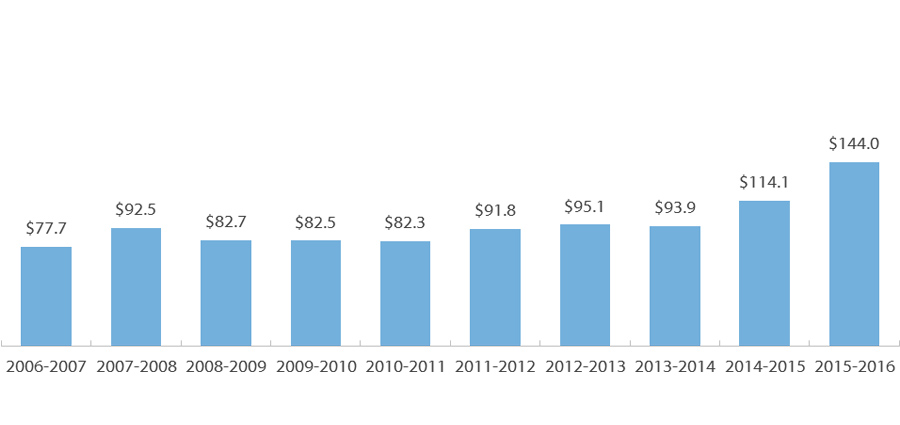

HHL-CAL Loan Volume by Award Year (in Millions of Dollars)*

The Hinson-Hazlewood College Access Loan (HHL-CAL) is the largest of the loan programs that the State of Texas offers for students. Recipients are not required to demonstrate financial need to receive HHL-CAL loans. A student may borrow up to the cost of attendance at his or her institution, minus any other financial aid he or she is receiving. In AY 2015-2016 HHL-CAL awards totaled $144.0 million, a dramatic 26 percent increase over the previous year. This marks the second year of dramatic increases in award totals for this loan program.

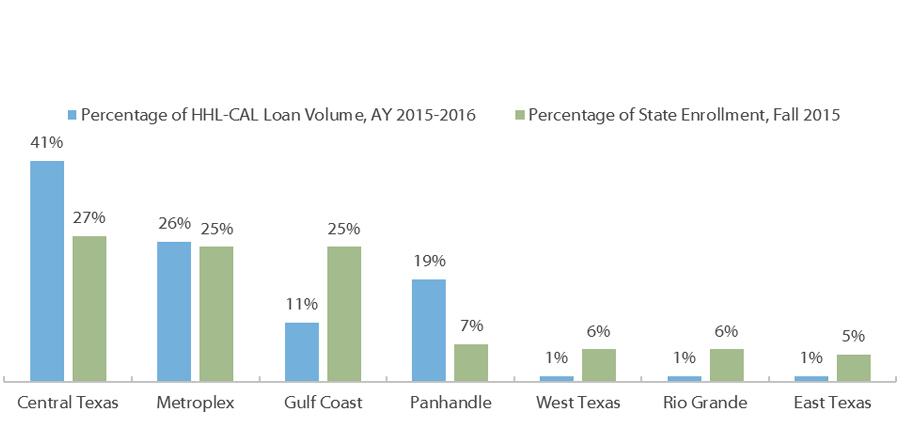

HHL-CAL Volume and Enrollment by Region

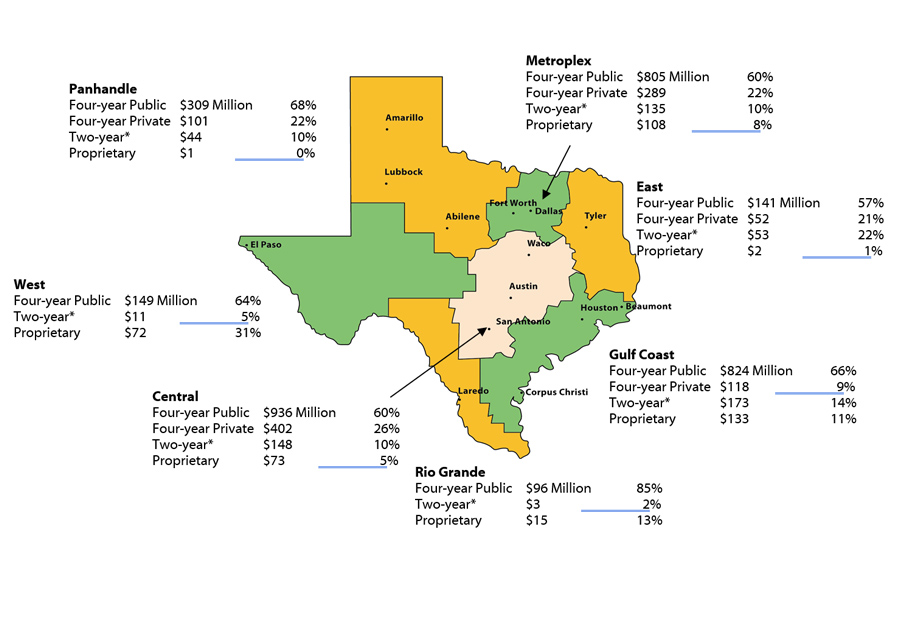

In AY 2015–2016, 41 percent of the HHL-CAL dollars went to students attending schools in the Central Texas region. Although Central Texas comprises only 27 percent of Texas enrollment, it is home to the state’s two flagship universities, the University of Texas at Austin and Texas A&M University. The Metroplex region received approximately the same percentage of HHL-CAL dollars as it represented in student enrollment. All other regions, except for the Panhandle region, received a smaller percentage than their share of the state’s enrollment.

* Includes only the amounts reported in the Texas Higher Education Coordinating Board’s Financial Aid Database. The Financial Aid Database primarily records aid that was based on financial need, but may include some amounts that were not based on need.

Sources: Loan volume: Texas Higher Education Coordinating Board (THECB), “Financial Aid Database for AY 2015–2016,” Austin, Texas, 2017 (Unpublished tables); Data on loan terms and loan eligibility: THECB, “College for Texans” Website (http://www.collegeforalltexans.com/apps/financialaid/tofa.cfm?Kind=L); Enrollment: THECB. Texas Higher Education Data (http://www.txhighereddata.org/).

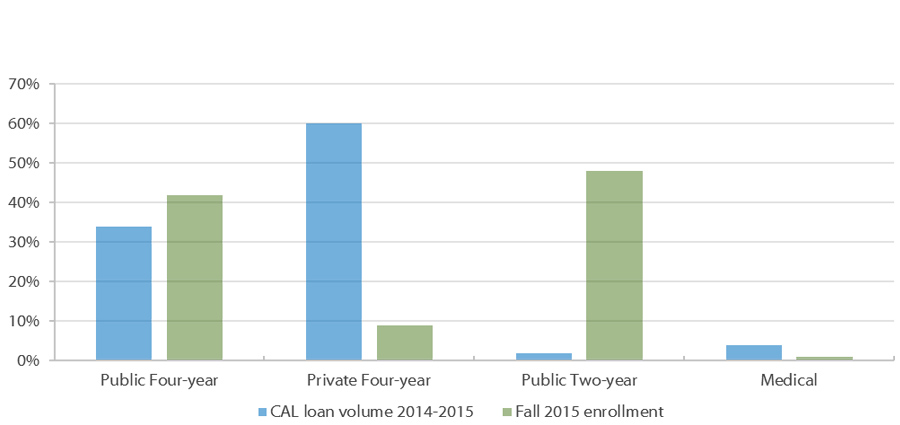

HHL-CAL Volume and Student Enrollment by Sector

The majority of students in Texas attend public colleges and universities. However, the proportion of Hinson-Hazlewood-College Access Loan (HHL-CAL) volume by school type does not parallel student enrollment.* In Award Year (AY) 1996–1997, 28 percent of HHL-CAL loan volume went to students in public universities and 68 percent went to students in private universities. The gap between the percentages narrowed throughout the 1990s. By AY 2002–2003, the percentage of HHL-CAL loan volume going to students in public institutions was greater than that going to students attending private institutions. About 51 percent of all HHL-CAL volume in AY 2007–2008 went to students in public four-year universities and 45 percent went to students in private four-year universities.

However this trend has been reversing in recent years. In AY 2015– 2016, 34 percent of HHL-CAL dollars went to students attending public four-year institutions, and this sector accounted for 42 percent of student enrollment. Private four-year students accounted for 9 percent of enrollment in Texas postsecondary institutions, but 60 percent of HHL-CAL volume. Similarly, public two-year students accounted for 48 percent of enrollment, but only 2 percent of HHL-CAL volume. This disproportionate pattern is at least partially because the cost of attendance at public two-year schools is generally lower than at four-year schools.

* HHL-CAL volume data for students who attended for-profit institutions are not available.

Sources: Loan volume: Texas Higher Education Coordinating Board (THECB). “Financial Aid Database, 2015-2016,” Austin, Texas, 2017 (Unpublished tables); Public Enrollment: THECB. “PREP Online” (http://www.txhighereddata.org/Interactive/PREP_New).

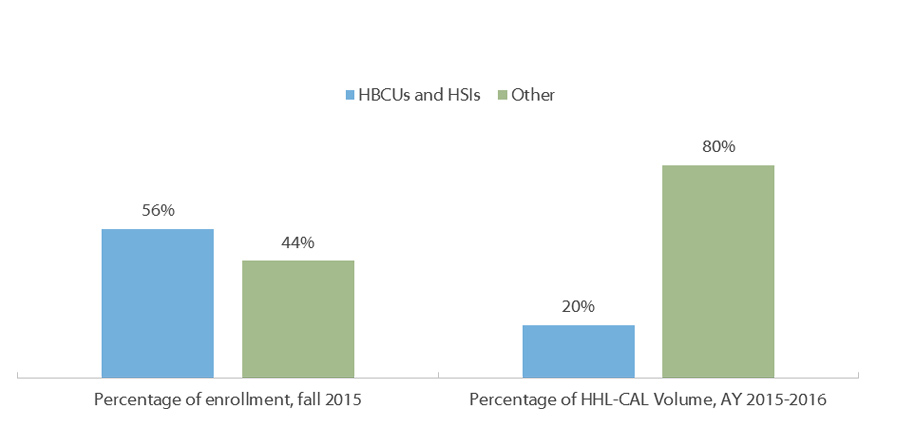

HHL-CAL Volume and Enrollment*

Texas has nine Historically Black Colleges and Universities (HBCUs) and 82 Hispanic-Serving Institutions (HSIs). In Award Year (AY) 2005–2006, HBCUs and HSIs comprised 33 percent of total Texas enrollment and received 14 percent of Hinson-Hazlewood College Access Loan (HHL-CAL) dollars. In AY 2015–2016, HBCUs and HSIs comprised 56 percent of total Texas enrollment and received 20 percent of HHL-CAL dollars. This gap has widened compared to last year as the enrollment at HBCUs and HSIs makes up a larger portion of the overall higher education enrollment.

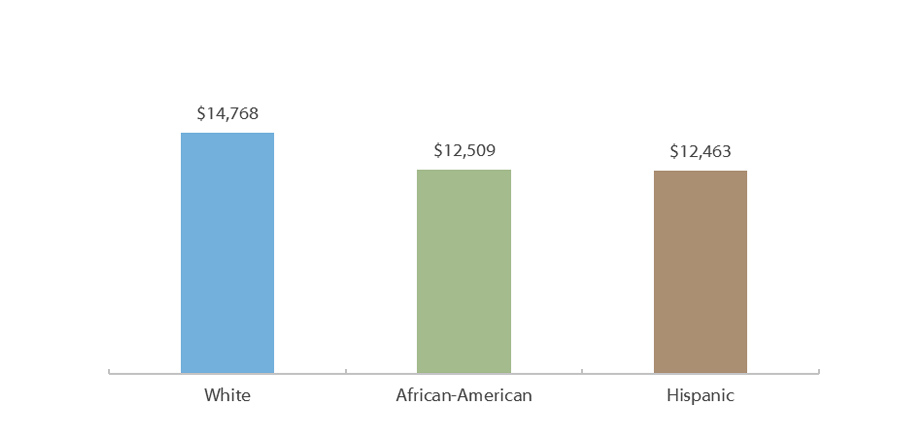

Average HHL-CAL Award by Ethnicity (AY 2015-2016)

The average HHL-CAL award differed across ethnic groups in AY 2015–2016. White students on average borrowed about $2,259 more than African-American students and $2,305 more than Hispanic students.

* Includes only the amounts reported in the Texas Higher Education Coordinating Board’s Financial Aid Database. The Financial Aid Database primarily records aid that was based on financial need, but may include some amounts that were not based on need.

Sources: Loan volume: Texas Higher Education Coordinating Board (THECB). “Financial Aid Database for AY 2015–2016.” Austin, Texas, 2017 (Unpublished tables); Enrollment: THECB. Texas Higher Education Data (http://www.txhighereddata.org/). HBCUs: U.S. Department of Education, Office for Civil Rights database. “Accredited Postsecondary Minority Institutions” (http://www.ed.gov/about/offices/list/ocr/edlite-minorityinst.html); HSIs: U.S. Department of Education, unpublished report (special request).

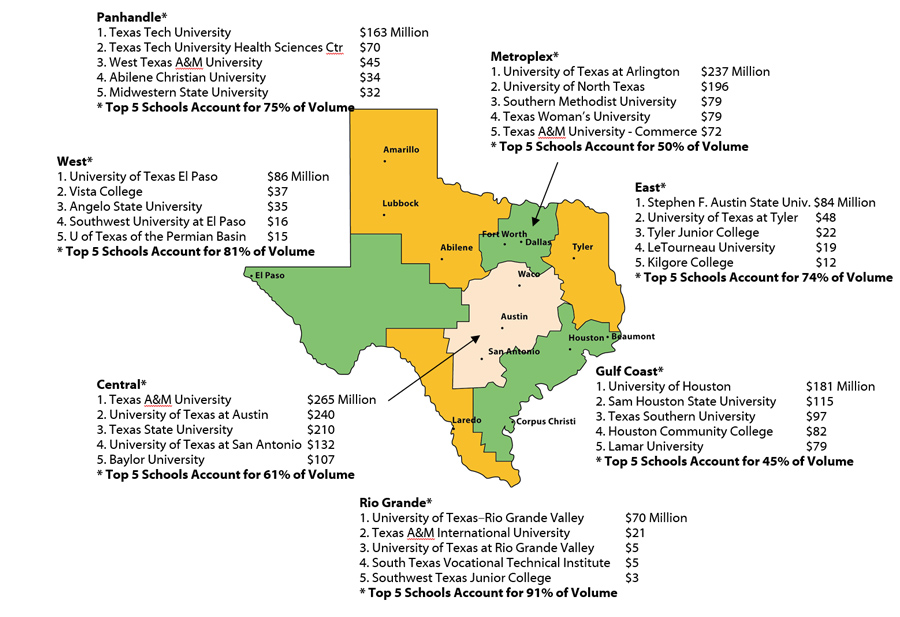

Top Schools by Region (AY 2016–2017)

In the rural areas of the state, Award Year (AY) 2016–2017 Federal Direct Loan Program (FDLP) volume remains concentrated among a few schools. In regions that contain the state’s largest cities, loan volume is more widely distributed. For example, in the Rio Grande region, five schools account for 91 percent of regional loan volume, while in the Gulf Coast region the five schools with the largest loan volume account for less than half of regional volume. This is most likely due to the greater number of school choices that exist in the more urbanized regions of the state.

Sources: U.S. Department of Education, Federal Student Aid Data Center, Programmatic Volume Reports (https://studentaid.ed.gov/sa/about/data-center/student/title-iv).

Federal Loan Volume by Region and School Type In Millions of Nominal Dollars (AY 2016–2017)

Four-year public school volume makes up the largest share of the volume in all regions. Proprietary school volume exceeds two-year* school volume in two regions. In Award Year (AY) 2016–2017, public four-year schools accounted for 63 percent of the state’s Federal Direct Loan Program (FDLP) volume. Four-year private school volume accounted for 19 percent, two-year* school volume accounted for 11 percent, and proprietary school volume accounted for 8 percent of total FDLP volume in Texas.

Texas Federal Loan Volume by School Type AY 2016–2017

| School Type | Amount (in Millions) | % of Amount |

|---|---|---|

| Public Four-year | $3,259 | 63% |

| Private Four-year | $962 | 19% |

| Two-year* | $566 | 11% |

| Proprietary | $403 | 8% |

*The two-year category includes both public and private, not-for-profit, and excludes proprietary.

Source: : U.S. Department of Education, Federal Student Aid Data Center, Programmatic Volume Reports (https://studentaid.ed.gov/sa/about/data-center/student/title-iv).

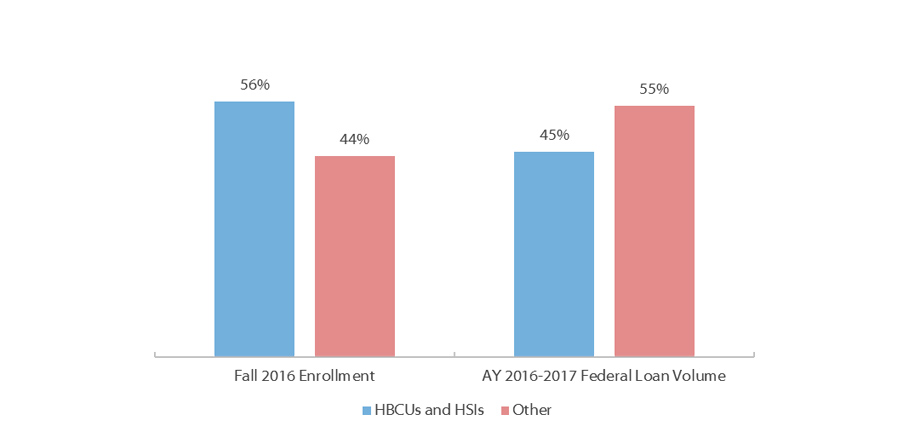

Ratio of HBCU/HSI Federal Loan Volume to HBCU/HSI Enrollment*

Texas has nine Historically Black Colleges and Universities (HBCUs) and 82 Hispanic Serving Institutions (HSIs). HBCUs and HSIs accounted for 56 percent of total Texas enrollment in fall 2016 while generating 45 percent of Award Year 2016–2017 Federal Direct Loan Program (FDLP) volume.

HBCUs are higher education institutions that were established prior to 1964 with the intention of primarily serving the African-American community, though students of all races and ethnicities are welcome to apply. There are 107 HBCUs nationwide.

Institutions meeting certain eligibility criteria, such as having at least a 25 percent Hispanic undergraduate enrollment, can apply for federal funding under Title III of the Higher Education Act. This federal program helps HSIs better serve their populations, which often include first generation and low-income students.

*Does not include proprietary schools for volume or enrollment.

Sources: Enrollment: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS) 2017 (http://nces.ed.gov/ipeds/); Loan Volume: U.S. Department of Education, Federal Student Aid Data Center, Programmatic Volume Reports (https://studentaid.ed.gov/sa/about/data-center/student/title-iv); HBCUs: U.S. Department of Education, Office for Civil Rights database. “Accredited Postsecondary Minority Institutions” (http://www.ed.gov/about/offices/list/ocr/edlite-minorityinst.html); HSIs: U.S. Department of Education, unpublished report (special request).

The Ohio State University administered a survey in 2014 to students attending 52 public and private not-for-profit institutions across the nation. This survey, the National Student Financial Wellness Study, collects data on the financial attitudes and practices of college students.

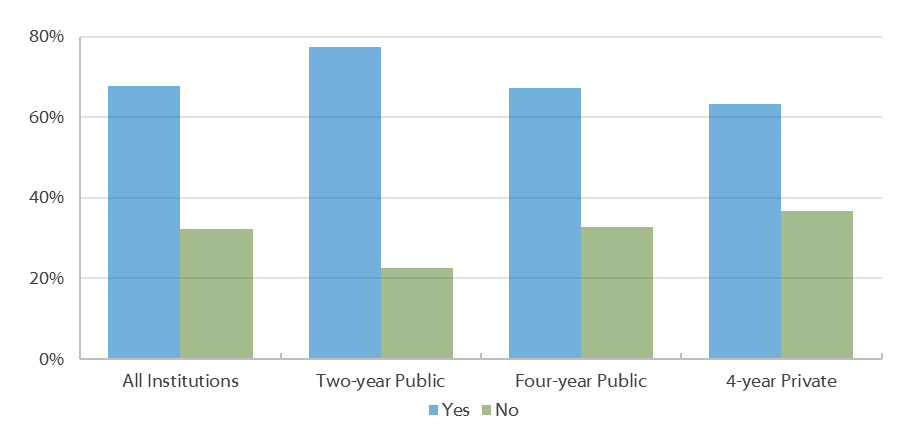

Sixty-four percent of students use loans to pay for college, and 35 percent report that student loans are the primary way they pay for tuition. Students who borrow federal loans are required to complete student loan counseling – entrance counseling – prior to accessing the funds. Entrance counseling has changed significantly over its 30-year history, starting as a customized in-person experience to what is now a counseling session packed with 28 federally mandated topics conducted mostly through online tools. A poll of the National Association of Student Financial Aid Administrators (NASFAA) member schools conducted in 2012 found that 71 percent reported using the U.S. Department of Education’s online tool to satisfy the counseling requirement. Only 20 percent reported that most of their loan counseling was conducted face-to-face.

Several issues with entrance counseling may make it difficult for students to absorb and retain the information being presented. First, entrance counseling occurs just before or at the very beginning of the start of classes, a time that can be overwhelming and distracting for students. In addition to possible timing issues, the number of required topics can lead to information overload, causing students to skim and skip through parts of the counseling.

Do you remember completing the entrance counseling for your student loan?

Source: NASFAA member poll: National Association of Student Financial Aid Administrators, Financial Aid Administrators Discuss Loan Counseling Challenges (2012) (https://www.nasfaa.org/news-item/1907/Financial_Aid_Administrators_Discuss_Loan_Counseling_Challenges); OSU student survey: The Ohio State University Office of Student Life, College of Education and Human Ecology, National Student Financial Wellness Study: Key Findings Report (2014) (http://cssl.osu.edu/posts/documents/nsfws-key-findings-report.pdf); All else: TG Research, Effective Counseling, Empowered Borrowers: An Evidence-Based Policy Agenda for Informed Student Loan Borrowing and Repayment, by Chris Fernandez (2016) (http://trelliscompany.staging.wpengine.com/wp-content/uploads/2019/05/Effective-Counseling-Empowered-Borrowers.pdf).

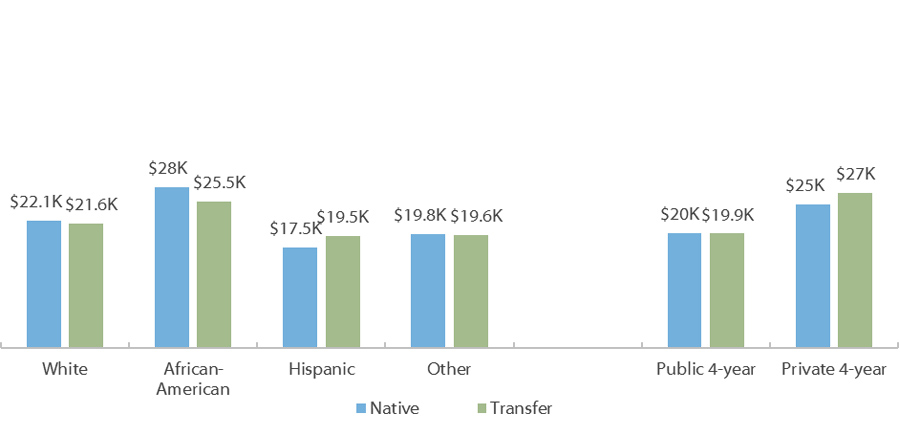

U.S. Low-income AY 2007-2008 Bachelor’s Recipients’ Median Cumulative Loan Debt through AY 2007-2008, by Race/Ethnicity and Sector

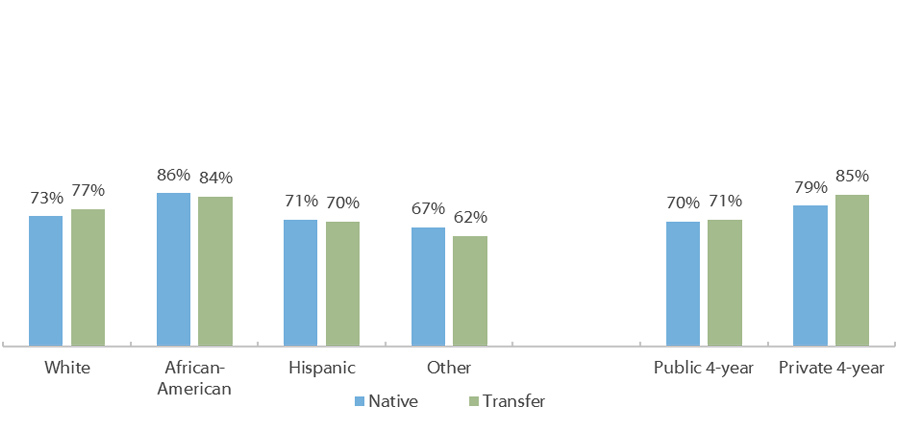

Percentage of U.S. Low-income AY 2007-2008 Bachelor’s Recipients Who Borrowed Any Student Loan, by Race/Ethnicity and Sector

Low- and middle-income bachelor’s degree recipients borrowed about the same student loan amounts regardless of whether they started at a two-year college or a four-year university. Most transfer students were not able to avoid borrowing by starting at a community college and generally borrowed more than “native” students during their final years of college. Transfer students also tended to recieve less grant and institutional aid than native students, especially at four-year private universities, which likely increased their need to borrow at their four-year institutions.

Many factors contribute to higher borrowing among transfer students. Transfer students tend to receive less grant aid, but they also tend to enroll at schools that provide less grant aid to all students, to have lower incomes and lower SAT scores, and to take significantly longer to finish their degrees. Prospective transfer students face many challenges. According to a 2009 study by the National Center for Education Statistics, only about one third of community college students who intend to transfer to a university actually end up doing so within three years, and several studies have reported better academic outcomes for students of four-year universities versus community colleges. High school students should consider these trends as well as their individual goals and circumstances in making their postsecondary enrollment decisions.