Students piece together financial support from a variety of sources. Some aid (e.g., tuition waivers, grants, family support) directly reduces out-of-pocket expenses for students, while forms of credit postpone payments in exchange for paying fees and interest. Colleges that understand how their students are paying for college can take steps to help their students secure and manage stable funding that enables them to graduate while avoiding financial pitfalls.

- Many students signaled concern with being able to afford college. (Q51)

- More than three in five respondents at 2-year (61 percent) – and 4-year (70 percent) institutions – agreed or strongly agreed that they worry about having enough money to pay for school.

- Many students lacked a financial plan to return for the next semester. (Q52)

- A quarter of respondents at 4-year institutions – and 22 percent of respondents at 2-year institutions – disagreed or strongly disagreed that they knew how they would pay for college next semester.

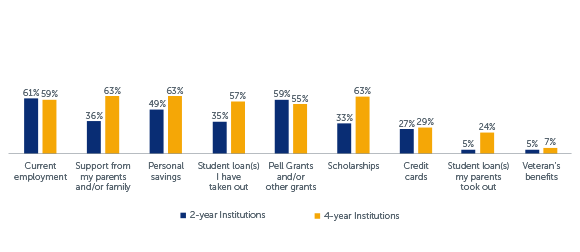

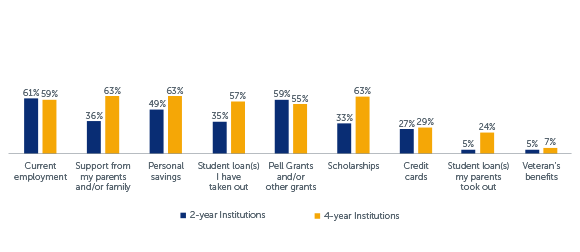

Q30-38: Do you use any of the following methods to pay for college? Respondents who answered ‘Yes’

Students use a variety of sources to pay for college. (Q30-38)

- More than three in five respondents at 2-year institutions – and 59 percent at 4-year institutions – report that they use their current employment to pay for college.

- Only 36 percent of respondents at 2-year institutions use support from their parents and/or family to pay for college, compared to 63 percent of 4-year respondents.

- Respondents at 4-year institutions also report using personal savings and scholarships to pay for college at higher rates compared to 2-year institutions.

Credit cards are a common, though risky, way to pay for college if students fail to pay their balance and incur high interest rates. (Q30-38)

- More than a quarter of respondents at 2-year and 4-year institutions report that they use credit cards to pay for college.

Respondents at 4-year institutions – and their parents – take out student loans at greater rates than community college students. (Q30-38)

- At 2-year institutions, 35 percent of respondents indicated that they paid for college with student loans they took out for themselves. Borrowing was more common among respondents at 4-year institutions (63 percent).

- Only five percent of respondents at 2-year institutions report that their parent(s) took out a student loan to help them pay for college, compared to nearly a quarter of respondents at 4-year institutions.

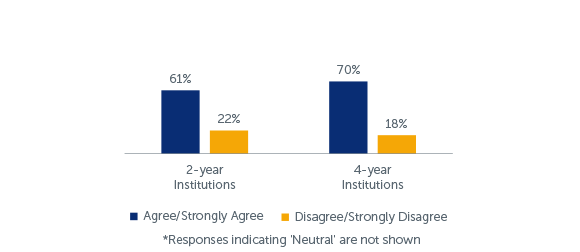

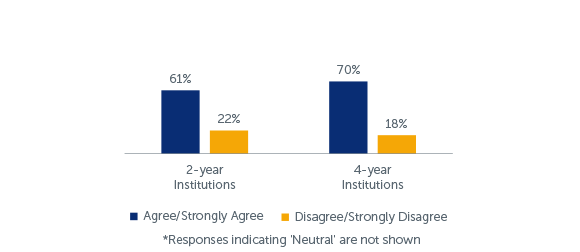

Q51: I worry about having enough money to pay for school.*

Many students signaled concern with being able to afford college. (Q51)

- More than three in five respondents at 2-year institutions – and 70 percent of respondents at 4-year institutions – agreed or strongly agreed that they worry about having enough money to pay for school.

- Respondents who were worried about having enough money to pay for school were more likely to be first-generation students, more likely to be under 25 years of age, and more likely to be female. See Appendix C for detailed tables on these findings.

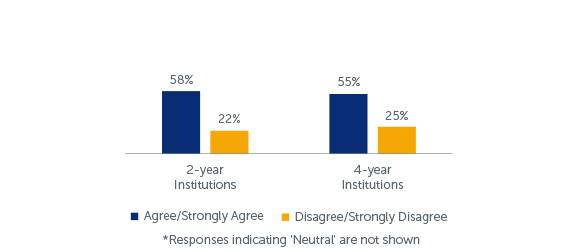

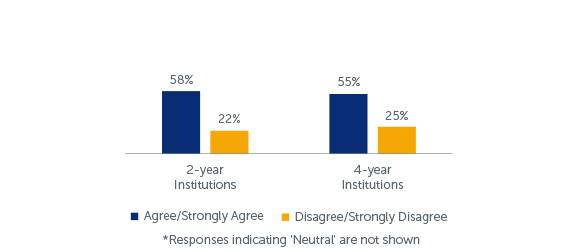

Q52: I know how I will pay for college next semester.*

Many students also lacked a financial plan to return for the next semester. (Q52)

- A quarter of respondents at 4-year institutions disagree or strongly disagreed that they knew how they would pay for college next semester. At 2-year institutions, 22 percent did not know how they would pay for the next semester.

- Respondents who did not know how they would pay for college next semester were more likely to be first-generation students and more likely to be female. See Appendix C for detailed tables on these findings.

Paying for college can be challenging. Sometimes funding from parents and jobs can dry up suddenly or unforeseen expenses can abruptly arise. In these cases, even modest grants, if distributed promptly, can be enough to meet the immediate need and keep the student in school.1,2

While most colleges work with a student to develop a plan to meet academic goals, it is less common – but no less essential – to develop financial plans for degree completion. Such plans can reduce student stress, prepare the student for unanticipated financial disruptions, and identify funding gaps early enough to shift resources and priorities to ensure retention.

Nearly three out of four students have unmet need – the out-of-pocket cost of college beyond expected family contribution, grants, scholarships, and work-study. Those with greater unmet need are less likely to persist in college.3, 4 Institutions that use high unmet need as a retention risk-factor may consider unmet need levels when packaging student aid, fundraising for institutional grant aid, and advocating for increased funding for state and federal student aid programs.