While families usually provide significant emotional support to students, many students have family responsibilities that can create or exacerbate financial challenges while in school. Institutions often do not have good data on how many of their students are parents or guardians or financially supporting family members.

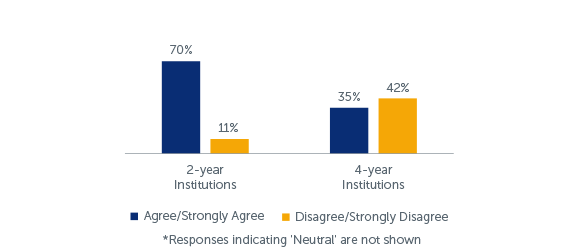

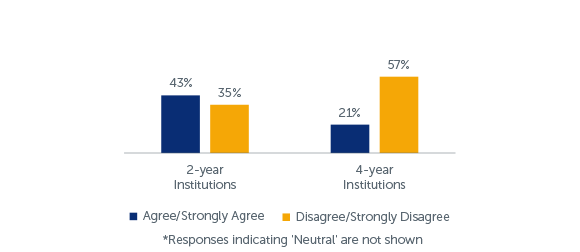

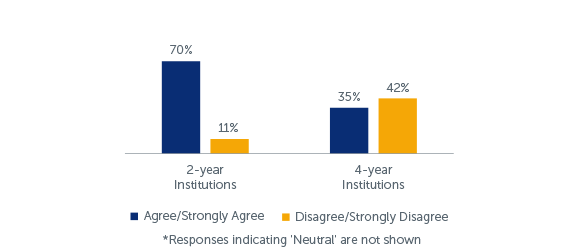

- Respondents at 2-year institutions were more likely to report that their institutions work to make tuition more affordable. (Q7)

- More than two-thirds of respondents (70 percent) at 2-year institutions agreed or strongly agreed that their school works to make tuition more affordable, compared to 35 percent of 4-year respondents.

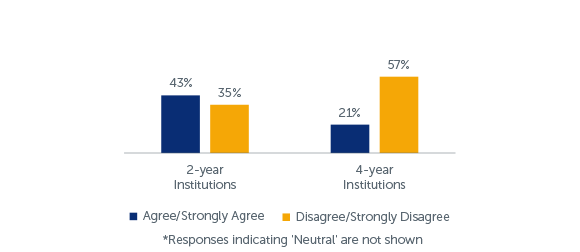

- One common concern of students is that many classes required textbooks that are too expensive. (Q11)

- More than a third of respondents at 2-year institutions (35 percent) – and 57 percent at 4-year institutions – disagreed or strongly disagreed that their school works to make textbooks more affordable.

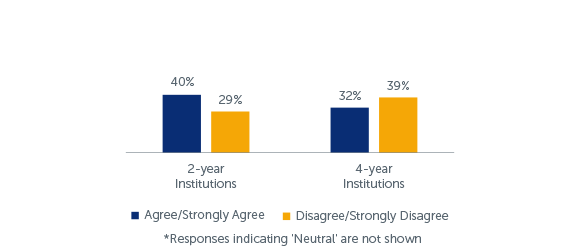

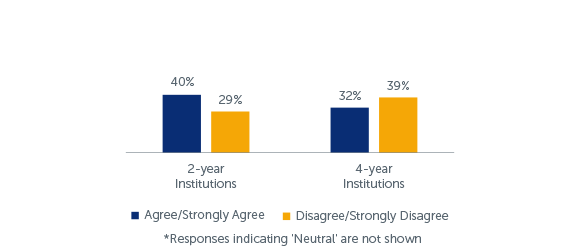

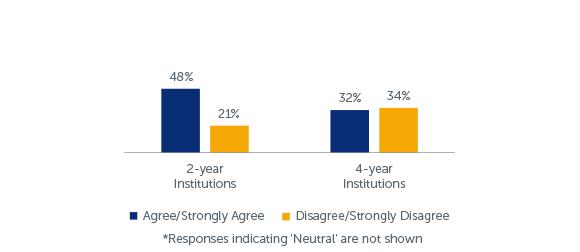

Q3: My school is aware of the financial challenges I face.*

Students disagree over the extent that their schools work to reduce student financial challenges. (Q3)

- At 2-year institutions, 40 percent of respondents agreed or strongly agreed that their school is aware of the financial challenges they face, but 29 percent disagreed or strongly disagreed.

- At 4-year institutions, the work schools do to reduce financial challenges is less apparent. Nearly a third of respondents agreed or strongly agreed that their school is aware of the financial challenges they face, but 39 percent disagreed or strongly disagreed.

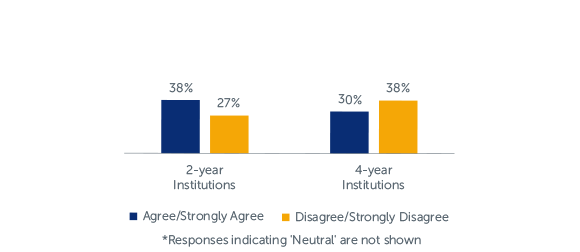

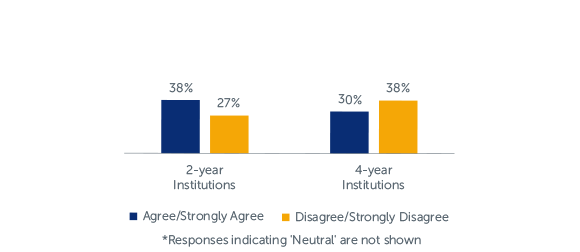

Q4: The faculty at my school understands my financial situation.*

Students often interact with faculty more than any other employees of their institution. Instructors who are empathetic with students’ financial struggles – and are aware of resources on campus to direct students to – can contribute to students’ sense of campus belonging and work with students to prevent their circumstances from causing academic issues. (Q4)

- At 2-year institutions, 38 percent of respondents agreed or strongly agreed that their school’s faculty understand their financial situation, but more than a quarter disagreed or strongly disagreed.

- At 4-year institutions, 30 percent of respondents agreed or strongly agreed that their school’s faculty understand their financial situation, and 38 percent disagreed or strongly disagreed.

Q7: To what extent do you agree or disagree that your school makes tuition more affordable?*

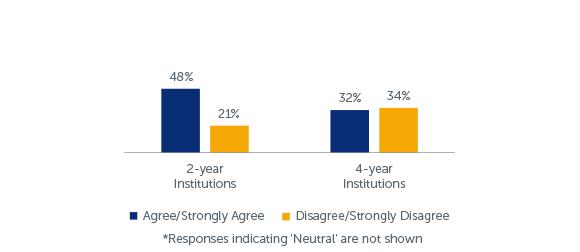

Q12: To what extent do you agree or disagree that your school makes required class supplies more affordable?*

Respondents at 2-year institutions were more likely to report their institutions work to make tuition and class supplies more affordable. (Q7, Q12)

- Seventy percent of respondents at 2-year institutions agreed or strongly agreed that their school works to make tuition more affordable, compared to 35 percent of 4-year respondents.

- Nearly half of respondents at 2-year institutions agreed or strongly agreed that their school works to make required class supplies more affordable, compared to 32 percent of 4-year respondents.

Q11: To what extent do you agree or disagree that your school makes textbooks more affordable?*

One common concern of students is that many classes require textbooks that are too expensive. (Q11)

- More than a third of respondents at 2-year institutions – and 57 percent at 4-year institutions – disagreed or strongly disagreed that their school works to make textbooks more affordable.

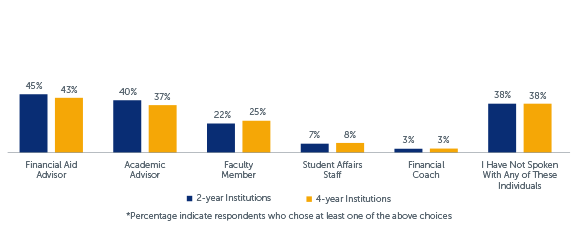

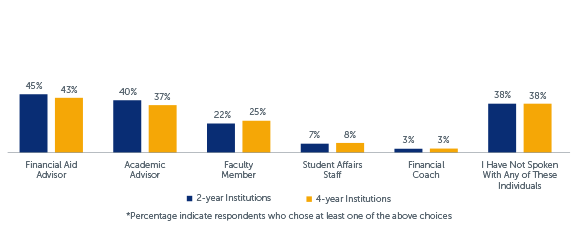

Q13-18: During my time at school, I have spoken with the following individuals about my financial struggles. (Check all that apply)*

Respondents were more likely to speak to a financial aid advisor about their financial struggles, followed by academic advisors, and faculty members. (Q13-18)

- At 2-year institutions, respondents most commonly reported speaking to a financial aid advisor (45 percent), followed by academic advisors (40 percent) and faculty members (22 percent).

- The response at 4-year institutions was similar to the response of students at 2-year schools, but with a greater propensity to speak with a faculty member. Respondents most commonly reported speaking to a financial aid advisor (43 percent), followed by academic advisors (37 percent) and faculty members (25 percent).

- More than a third of respondents at 2-year (38 percent) and 4-year institutions (38 percent) had not spoken with any of the individuals listed about their financial struggles.

Institutions can intentionally train staff and faculty about the financial realities of their student body. While these efforts should not be intended to make these individuals into financial advisors or professionals, the ability to recognize, empathize with, and direct to appropriate resources are important skills for front line staff and faculty to have in supporting student finances.

Institutions are having discussions with faculty and staff related to reducing some supplemental costs of education. Many colleges are utilizing open educational resources (OER) – textbooks and materials that are openly licensed – to reduce the cost of textbooks for students.

24

Kansas State University has saved students $5.5 million in costs since 2013, the University of Minnesota implementation has resulted in $3.5 million in savings since Fall 2015, and The Ohio State University has seen $3 million in savings since 2016. Other institutions have switched to digital platforms created by textbook publishers that include interactive elements but cost less than printed textbooks.25