Financial security refers to the abilities or perceptions of students to meet current, ongoing, and unexpected expenses. Financial security reduces stress to create a mental state conducive to study. A growing body of research shows that students who left college before earning a degree often did so for financial reasons or because it was too stressful to work and go to school at the same time.

6 In the 2017 National College Health Assessment, 36 percent of students reported that their finances in the previous year were “traumatic or difficult to handle.”

7 In addition to the mental and emotional toll of financial insecurity, students surviving on narrow margins are more vulnerable to academic disruptions caused by unexpected expenses.

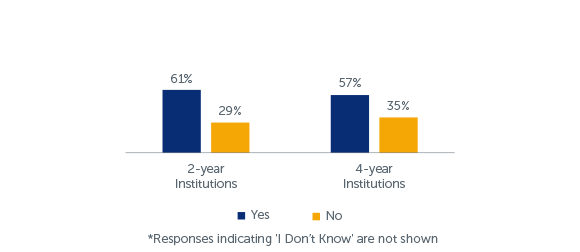

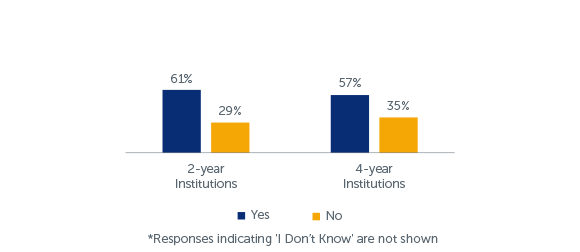

- Students’ finances appear precarious, susceptible to unexpected expenses that might derail their academic standing. (Q44, Q45)

- More than three in five respondents (61 percent) at 2-year institutions – and more than half of 4-year respondents (57 percent) – indicated they would have trouble getting $500 in cash or credit in an emergency.

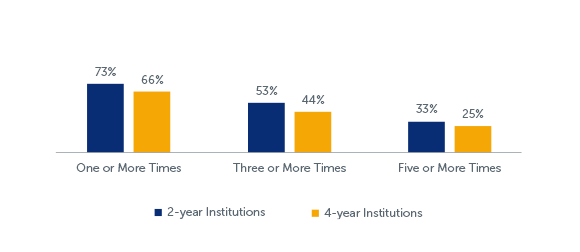

- A third of 2-year respondents and a quarter of 4-year respondents reported running out of money five or more times in the prior year.

Q44: Would you have trouble getting $500 in cash or credit in order to meet an unexpected need within the next month?*

For students who are financially vulnerable, a relatively small expense can force difficult decisions around staying enrolled in college. (Q44)

- More than three in five respondents at 2-year institutions – and 57 percent of 4-year respondents – indicated they would have trouble getting $500 in cash or credit in an emergency.

- Students who reported they would have trouble getting $500 cash or credit in an emergency responded at higher rates that they worry about having enough money to pay for school (Q51) and at lower rates that they know how they will pay for college next semester (Q52). These students were also more likely to be first-generation and more likely to be enrolled full-time. See Section C in the technical supplement for detailed tables on these findings.

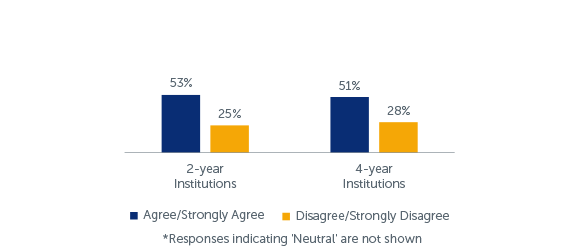

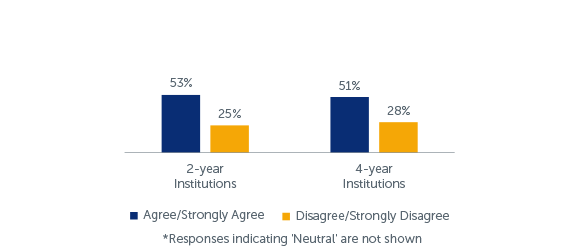

Q50: I worry about being able to pay my current monthly expenses.*

Some of the anxiety around paying for school may be driven by students’ concern over their day-to-day expenses. (Q50)

- More than half of respondents at 2-year and 4-year institutions agreed or strongly agreed that they worry about paying for their current monthly expenses.

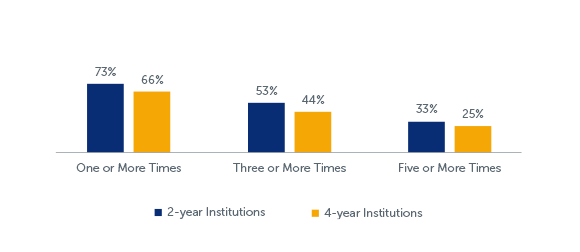

Q45: In the past 12 months, how many times did you run out of money?

It takes careful planning for students to meet their expenses and manage a limited, often uncertain cash flow while attending school. (Q45)

- Nearly three-quarters of respondents at 2-year institutions – and two-thirds of 4-year respondents – reported running out of money at least once in the past 12 months.

- Alarmingly, a third of 2-year respondents and a quarter of 4-year respondents reported running out of money five or more times in the prior year.

- Those who ran out of money five or more times were more likely to be first-generation students and more likely to have trouble getting $500 in case of an emergency (Q45). These students also responded at higher rates that they worry about having enough money to pay for school (Q52) and at lower rates that they know how they will pay for college next semester (Q53). See Appendix C for detailed tables on these findings.

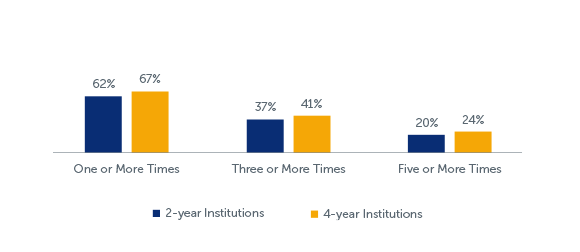

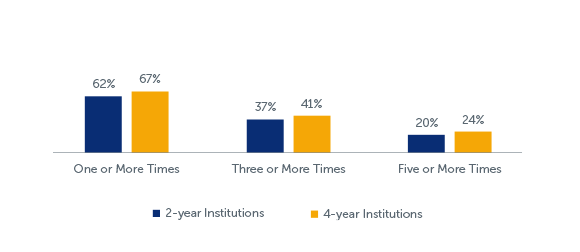

Q46: In the past 12 months, how many times did you borrow money from your family and/or friends?

For students with access to financial support from friends and family, social borrowing is common. (Q46)

- Sixty-two percent of respondents at 2-year institutions and 67 percent of 4-year respondents reported borrowing money from family and/or friends at least once in the past year.

- Twenty percent of 2-year and 24 percent of 4-year respondents tapped into their social network five or more times.

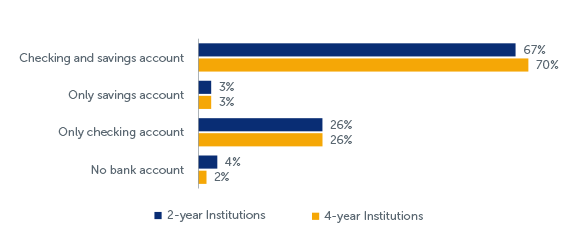

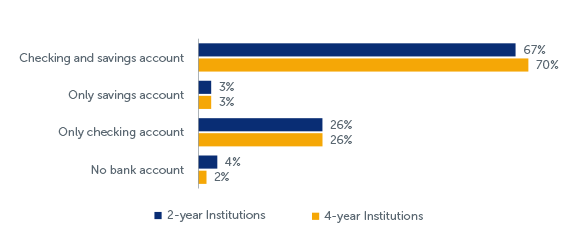

Q62: Do you have a bank account, and if so which of the following applies to you?

Students who do not have a checking and savings account may be more likely to turn to risky and expensive financial products such as check cashing services and payday lending. Alternately, banking is essential to asset building that can help them weather a financial emergency. (Q62)

- More than two-thirds of 2-year and 4-year respondents reported having a checking and savings accounts.

- However, more than a quarter of 2-year and 4-year respondents indicated that they only have a checking account and not a savings account.

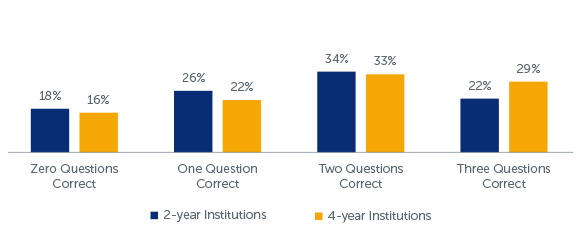

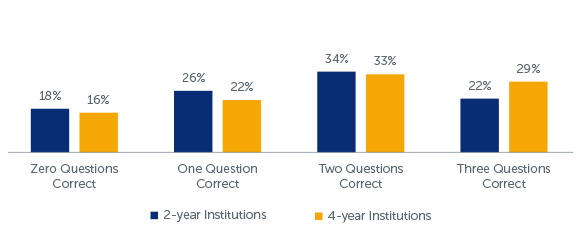

Q103-105: Financial Knowledge Scale

Understanding key financial terms and processes can be key to making informed financial decisions. Financial knowledge and behaviors are often all students have control of during times of scarce resources or emergency expenses. (Q103-105)

- Only 22 percent of 2-year respondents and 29 percent of 4-year respondents answered correctly on all three financial knowledge questions in the survey. However, 82 percent of 2-year and 84 percent of 4-year respondents answered at least one question correctly.

- The financial knowledge scale used in this survey is a version of the Lusardi three-question scale, augmented to be more relevant to students in higher education where borrowing is common. A full description of the scales used in the SFWS can be found in Section A of the technical supplement.

Campuses are supporting students with managing their cash flow challenges (particularly with financial aid recipients) and providing financial education to encourage budgeting and successful financial behaviors.

Campuses are implementing emergency aid programs that help students overcome temporary financial obstacles (e.g., car repairs, gaps in daycare coverage, rent assistance when roommates leave, and utility bill spikes).8 To better support schools who may be developing emergency aid programs, Trellis has developed a useful step-by-step guide for delivering emergency aid programs.8

Campuses are supporting and even incentivizing students to become enrolled in safe financial services (such as bank accounts). Access to a checking and savings account may reduce the chance students will use risky financial services (such as check cashing services, payday lending, etc.).9

One example of this, Austin Community College’s Rainy Day Saving Program, encourages students to save $500 by partnering with a local credit union to match $100 as students start to save.10